Think attending an Ivy League school is only possible for affluent families? Well, let’s debunk that myth a bit: approximately 75% of undergraduate students at Ivy League institutions receive financial aid, and you could be one of them!

Many families worry that top universities are only for those with six-figure incomes or for students whose families come from the top 1% of the income scale, and that financial aid is too complicated or limited to obtain. This stress hinders most students, even the brightest ones, from pursuing their applications. But in recent years, Ivy League schools have made financial aid more generous and transparent, with some covering 100% of tuition for students from families earning under $75,000 a year.

On January 27, 2026 (Eastern Time), Yale University announced a major expansion of its undergraduate financial aid program, showing how families earning under $200,000 can qualify for full tuition coverage. This move reflects a broader trend among elite U.S. universities to make world-class education more accessible to the most qualified applicants, no matter their financial status.

In this article, we will break down the details of Yale’s new policy, explore how it compares to the scholarship offerings of other Ivy League schools, and discuss some practical steps prospective students can take to attend a top university without the burden of overwhelming costs.

Understanding Yale’s Financial Aid: What’s Covered?

Yale’s financial aid expansion is not just about tuition fees. For qualifying students, this financial aid now extensively covers the following:

- Full tuition for the academic year

- Room and board

- Books and supplies

- Estimated round-trip travel expenses

- Mandatory health insurance

- A $2,000 start-up grant for freshmen, to help with initial living expenses

This broad coverage eradicates financial constraints that might prevent academically qualified students from focusing on their Yale education. According to Jeremiah Quinlan, Dean of Undergraduate Admissions and Financial Aid at Yale, “I am thrilled that Yale is making this important investment in affordability. With this announcement, we reiterate and reinforce Yale’s commitment to ensuring that cost will never be a barrier between promising students and a Yale College education.”

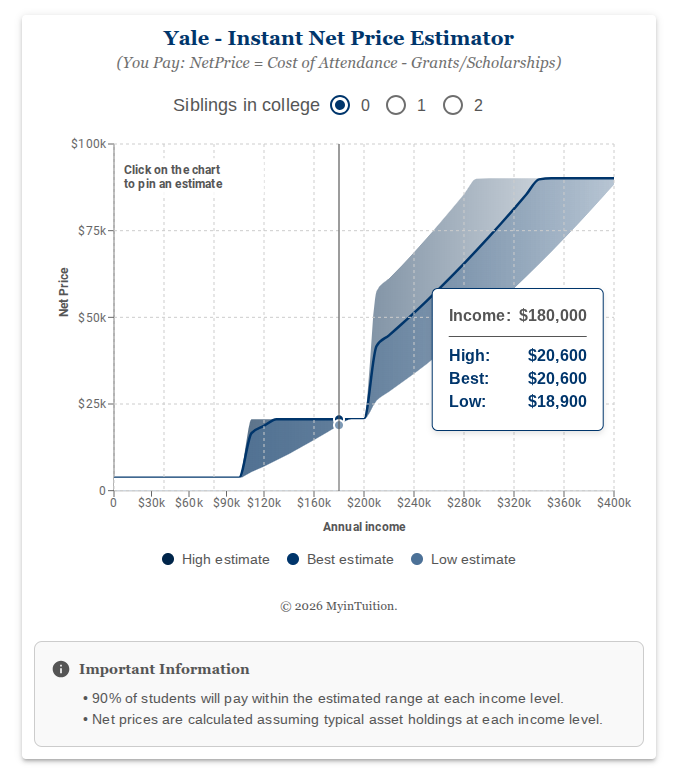

How to Estimate Your Costs: Yale’s Net Price Estimator

To give an idea of how much a Yale education would cost, the university introduced the Instant Net Price Estimator in October 2025. Through this tool, families can enter income and asset information to receive a personalized estimate in seconds. Utilizing this feature early in the application process will help you plan and compare multiple universities more effectively.

Yale’s Financial Aid Throughout the Years

Yale has long led the way in making prestigious education more accessible through financial aid. In 2010, it launched the Zero Parent Share program to cover tuition fees and alleviate the financial burden of qualified families. Originally, it applied to families earning under $65,000 per year, but in 2020 it expanded to include families earning up to $75,000 annually.

With the 2026 expansion, families earning up to $200,000 can now enjoy financial aid that covers full tuition, extending eligibility to over 80% of U.S. households.

This initiative, through the years, shows that Yale is not only following but leading a broader movement among elite universities to reduce economic barriers to higher education.

HYPSM Schools Financial Aid Comparison:

- Harvard: Full tuition coverage for families with annual income under $75,000; partial aid for families earning up to $150,000

- Princeton: Families earning less than $100,000 may pay no tuition; those with incomes up to $180,000 eligible for aid

- Stanford: Full tuition coverage for families with annual income under $150,000; sliding scale for families earning up to $250,000

- MIT: Full tuition coverage is available for families with incomes below $90,000

The above data just shows that Yale’s $200,000 threshold is among the most generous in the Ivy League and elite private university landscape.

Why Are Tuition Costs Rising at Top U.S. Universities?

U.S. college tuition has been increasing faster than inflation due to the following factors:

- Rising faculty salaries and research funding costs

- Expanding student services and campus infrastructure

- Growing demand from domestic and international applicants

How Yale Supports Students

Despite rising tuition costs, universities like Yale have chosen to offset costs for middle- and lower-income families through need-based financial aid. This ensures access to education remains meritocratic rather than wealth-based.

4 Advice for International Families and Students

Yale’s undergraduate admissions process is need-blind. This means that an applicant’s financial situation does not affect admissions decisions, regardless of nationality.

It’s important to note that for international students, financial aid is not determined solely by U.S. income standards. Instead, Yale conducts a comprehensive evaluation that takes into account the national economic conditions of the student’s home country and their family’s actual assets.

Below are some tips for international students and families planning for college applications in the U.S.:

- Start Planning Early: Financial aid requires complex documentation; they will ask you to prepare income statements, tax records, and asset information. Ensure that these documents are prepared well ahead of deadlines.

- Use Online Tools: Yale’s Net Price Estimator gives a clear estimate of your potential out-of-pocket costs.

- Consider Other Universities: Even if Yale is your main target, it’s best to compare financial aid policies at other institutions like Harvard, Princeton, MIT, Stanford, and others.

- Work with a Consultant: Experienced college advisors can help families navigate the application, financial aid forms, and timing strategy for both U.S. and international students.

By following these steps, you can navigate not just the financial aid process but the entire college application experience with confidence. With the right planning and guidance, financial concerns don’t have to stand in the way of applying to Yale or other top-tier universities.

Take the first step today and contact us to schedule a free consultation. Our consultants will help you create a personalized plan tailored to your goals and timeline, ensuring you make the most out of the many financial aid opportunities out there, both at Yale and beyond.

中文

中文 Tiếng Việt

Tiếng Việt